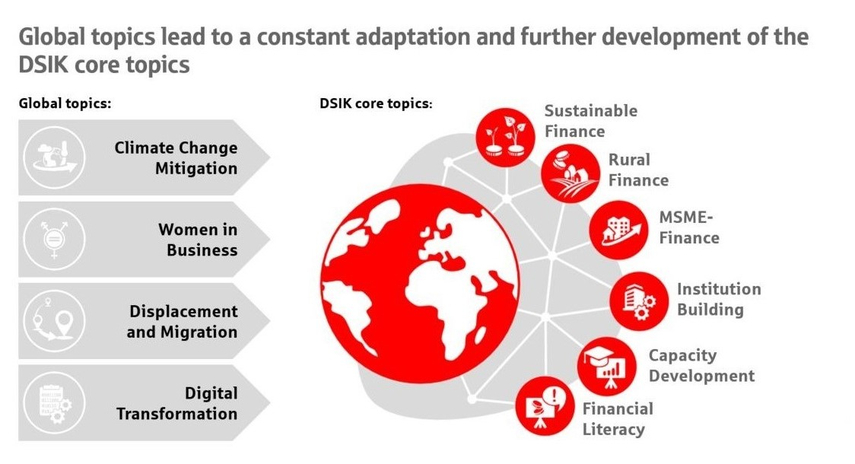

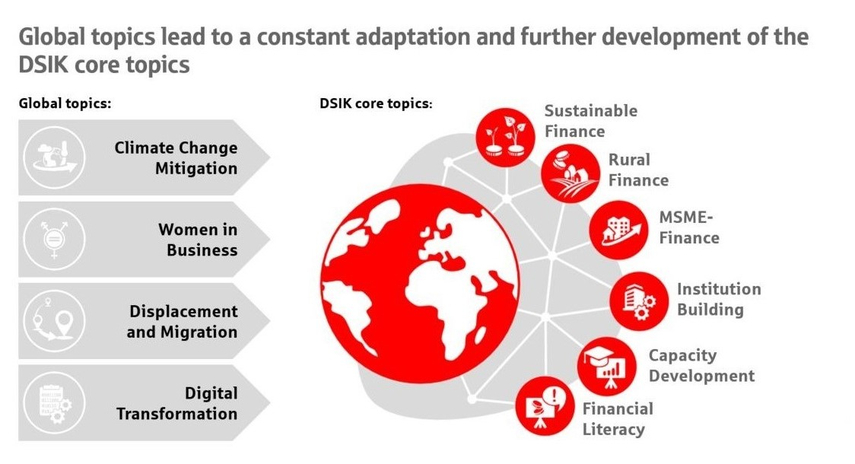

Sustainable Finance

Sustainable finance concerns investments that foster renewable energies and energy efficiency while enabling people to cope better with climate change (by promoting eco-friendly business developments, for example). German Sparkassenstiftung also assists local banks in developing financial products for investments in green technologies. Committed to the energy transition, Germany’s Sparkassen are the financial enabler behind a great number of small-scale projects realised by municipalities, medium-sized companies and homeowners.

» Read more

Rural Finance

Loans, savings products, insurance and payment transactions are at the heart of rural financing. Focused on the needs of agricultural smallholders and microenterprises, we help create needs-oriented and personalised agricultural financing products that take account of cropping cycles and seasonal fluctuations. Furthermore, rural financing also embraces entire value chains and hedging tools, such as targeted insurance solutions or payment and supply guarantees.

» Read more

MSME Finance

Micro, small and medium-sized enterprises (MSME) are the bedrock of economic growth and employment. But they need access to needs-oriented financial services to succeed. DSIK leverages the wealth of experience in the Sparkassen-Finanzgruppe (Savings Banks Finance Group) to assist banks and microfinance institutions to roll out and professionalise all aspects of lending – from product design through to staff training.

» Read more

Institution Building

‘Fair, caring, close by’ – German Sparkassen are adept at combining excellent financial returns with social responsibility. Moreover, they also make financial services accessible to everyone. Key factors driving their success include cost reductions due to their work in associations and increased profit thanks to their professionalism. By communicating and applying these key factors in its project work, DSIK is able to restructure retail banks and turn informal MFIs into regulated microfinance banks. Moreover, it also fosters the creation of associations that provide useful services to their members.

» Read more

Capacity Development

Training and HR development are integral components of all German Sparkassenstiftung’s projects. From introducing dual vocational training courses to establishing training academies, we take successful concepts and integrate them into our partners’ educational framework. Besides training local trainers to implement our specially devised business simulations, we also organise and conduct seminars.

» Read more

Financial Literacy

Since the decisions we make in life are often financial ones, it is absolutely imperative that we understand how money works. This explains why Germany’s Sparkassen (savings banks) are dedicated to strengthening business skills and know-how and to helping private households become more financially flexible. With their advisory services, such as the “Sparkassen SchulService” (School Service) for children and young people or the “Geld und Haushalt” (Money and Household) service for adults, they are helping to boost financial literacy throughout Germany. DSIK's work builds on this experience but customises the concepts and materials to fit the given country’s specific needs.

» Read more